The comments posted on this blog become part of the public domain. We don't edit comments to remove objectionable content, so please ensure that your comment contains none of the above. To file a detailed report about a scam, go to. We won’t post comments that include personal information, like Social Security numbers, account numbers, home addresses, and email addresses.We won’t post threats, defamatory statements, or suggestions or encouragement of illegal activity.We won’t post comments that include vulgar messages, personal attacks by name, or offensive terms that target specific people or groups.We won’t post off-topic comments, repeated identical comments, or comments that include sales pitches or promotions.We expect commenters to treat each other and the blog writers with respect. We review all comments before they are posted, and we won’t post comments that don’t comply with our commenting policy. But keep in mind, this is a moderated blog. Your thoughts, ideas, and concerns are welcome, and we encourage comments. The purpose of this blog and its comments section is to inform readers about Federal Trade Commission activity, and share information to help them avoid, report, and recover from fraud, scams, and bad business practices.

#Economic stimulus mailings download#

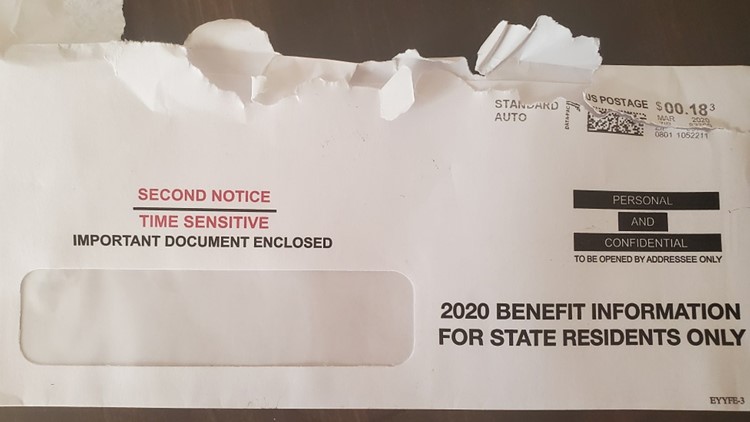

They’re fake, and they may be phishing for your personal information or might download malware to your computer, tablet, or phone. Also, watch out for emails and texts with attachments or links claiming to have special information about the payments. Remember, the IRS will not call, text you, email y ou, or contact you on social media asking for personal or bank account information – even related to the stimulus payments. Whether you’re waiting for your payment, or even if it’s already arrived, keep alert for scammers trying to steal your personal information, your money, or both. You also can find information here about payments that the IRS may have deposited to an account you don’t recognize.

If you have other concerns about your economic impact payment, visit the IRS’s Economic Impact Payment Information Center and Get My Payment Frequently Asked Questions pages for detailed, and frequently-updated, answers to questions. Use to report suspected identity theft only.

And, also will give you a recovery plan with steps you can take to help protect yourself from further identity theft. You also can download a copy of your completed Affidavit for your files. You can include a personal statement too, to tell the IRS details about how your identity was misused to claim your economic impact payment.

will ask you some questions so that it can complete an IRS Identity Theft Affidavit (IRS Form 14039) for you, and submit it electronically to the IRS. Click “Get started.” The next page asks, “Which statement best describes our situation?” Click the line that says, “Someone filed a Federal tax return – or claimed an economic stimulus payment – using my information.” You’re on your way. Visit, the government’s one-stop resource for people to report identity theft and get a personal recovery plan.

0 kommentar(er)

0 kommentar(er)